Whether you are a beginner or already know a little about trading, learning how to use the RSI indicator can help you make smarter decisions in the market.

The Relative Strength Index (RSI) is a popular tool that traders use to understand the momentum of an asset’s price and to spot potential buy or sell signals.

In this guide, we will explain what the RSI indicator is, how it works, and how you can use it in your trades. We’ll keep the language simple so that anyone can follow along!

What is the RSI Indicator?

The Relative Strength Index (RSI) is a technical indicator that measures how fast and how much the price of an asset is moving.

It ranges from 0 to 100 and helps traders identify whether an asset is overbought (priced too high) or oversold (priced too low).

- RSI above 70: The asset might be overbought, which could mean that the price is too high, and a reversal (price drop) might be coming.

- RSI below 30: The asset might be oversold, which could mean that the price is too low, and a reversal (price rise) might be coming.

The RSI is shown as a single line on a chart below the price of the asset, and traders use it to see if it’s a good time to buy or sell.

How Does the RSI Indicator Work?

The RSI indicator works by comparing recent gains and losses in the price of an asset. The result is a number between 0 and 100 that tells you whether the asset is gaining strength or losing it.

- Overbought condition: If the RSI is above 70, the asset has risen too quickly, and the price could be due for a drop.

- Oversold condition: If the RSI is below 30, the asset has dropped too fast, and the price might bounce back soon.

Most traders use the RSI over 14 days to get a better understanding of the current market conditions, but you can adjust the time frame depending on your strategy.

How to Use the RSI Indicator in Trading?

Now that you know what the RSI indicator is and how it works, let’s talk about how to use it in your trades. Below are some simple strategies that can help you get started.

1. RSI Overbought and Oversold Strategy

One of the simplest ways to use the RSI is to look for overbought and oversold conditions.

- When to buy: If the RSI is below 30, it means the asset is oversold. This could be a good time to buy, as the price might be about to rise.

- When to sell: If the RSI is above 70, the asset is overbought. This could be a good time to sell, as the price might soon fall.

However, it’s important to remember that the RSI doesn’t always predict an immediate price change.

Sometimes an asset can remain overbought or oversold for a while before it moves. So, it’s wise to combine the RSI with other indicators or signals to confirm the trade.

2. RSI Divergence Strategy

Another popular way to use the RSI is by looking for the divergence between the RSI and the price of the asset.

Divergence happens when the price of an asset is moving in one direction, but the RSI is moving in the opposite direction.

- Bullish Divergence: If the price is making new lows, but the RSI is making higher lows, it could signal that the downtrend is weakening, and the price might start going up soon.

- Bearish Divergence: If the price is making new highs, but the RSI is making lower highs, it might mean the uptrend is losing strength, and the price could fall soon.

Divergence is a powerful signal, but like any other strategy, it works best when combined with other indicators.

3. RSI Trendline Strategy

Just like you can draw trendlines on price charts, you can also draw trendlines on the RSI.

When the RSI is trending upward, it shows that the buying pressure is increasing, and when it is trending downward, it shows that the selling pressure is increasing.

- What to do: If you draw an upward trendline on the RSI and the line is broken, it might be a sign to sell. If you draw a downward trendline and it is broken, it might be a sign to buy.

This strategy works well in trending markets and can give you an early signal of a possible trend reversal.

Combining RSI with Other Indicators

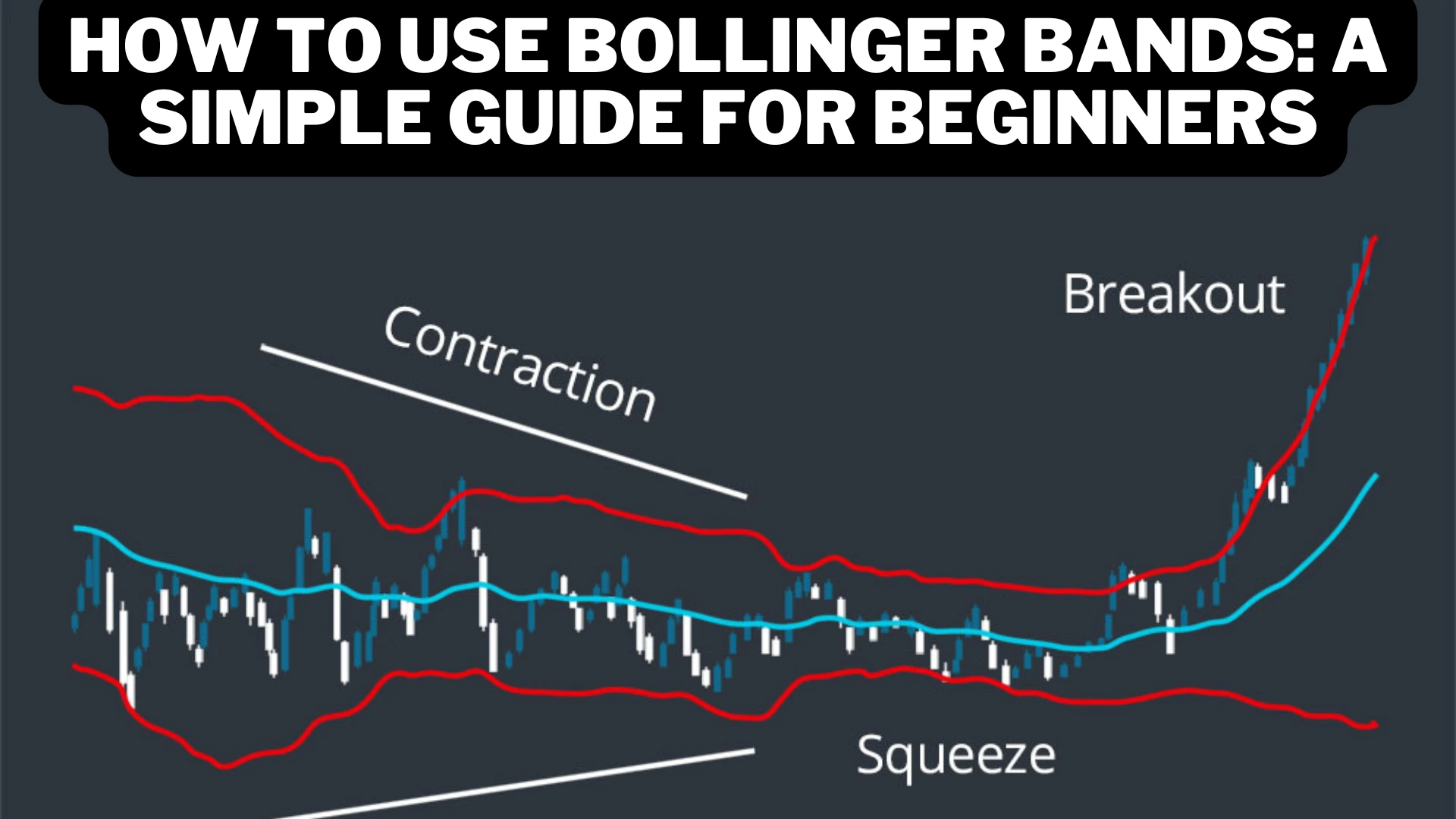

The RSI indicator works best when used with other technical tools. Some traders combine it with Moving Averages, Super Trend, Bollinger Bands, or Support and Resistance Levels to get a clearer picture of what’s happening in the market.

For example, if the RSI is giving you a buy signal, and the price is near a major support level, it could be a strong confirmation that the asset will rise.

On the other hand, if the RSI is giving a sell signal, and the price is near resistance, it could confirm a drop.

RSI Settings for Different Trading Styles

While the standard setting for RSI is a 14-period timeframe, you can adjust it depending on your trading style:

- Short-term traders: You might use a lower period, such as 7, to get quicker signals.

- Long-term traders: You may prefer using a longer period, such as 21, to avoid false signals and focus on the bigger picture.

You can also change the overbought and oversold levels (e.g., from 70 and 30 to 80 and 20) if you want to reduce the number of signals and focus only on stronger trends.

Tips for Using the RSI Indicator

- Don’t Rely Solely on RSI: While RSI is a great tool, it should not be the only indicator you use. Combine it with other tools or strategies to confirm your trades.

- Practice First: If you are new to the RSI indicator, it’s a good idea to practice using it on a demo account before trading with real money. This will help you get comfortable with how it works in real markets without any financial risk.

- Be Aware of Market Conditions: The RSI tends to work best in trending markets. In sideways or choppy markets, the RSI can give false signals, so be careful during such conditions.

Conclusion

The RSI indicator is a powerful tool that helps traders identify overbought and oversold conditions, spot potential trend reversals, and make better trading decisions.

By learning how to use the RSI effectively, you can gain a better understanding of market momentum and take advantage of good buying and selling opportunities.

Remember to always practice on a demo account, use the RSI with other indicators for confirmation, and manage your risk to become a more successful trader.