Bollinger Bands are one of the most popular tools used in technical analysis. Whether you’re a beginner or an experienced trader, understanding how to use Bollinger Bands can help you make better trading decisions.

In this guide, we’ll break down everything you need to know about Bollinger Bands, how they work, and how to use them in your trading strategy.

180 Life Sciences Expands Into Online Gaming With Blockchain Technology

What Are Bollinger Bands?

Bollinger Bands are a type of chart indicator used to measure market volatility. Created by John Bollinger in the 1980s, these bands consist of three lines:

- Middle Band: This is the simple moving average (SMA) of a stock or asset price. The most common period for this SMA is 20 days.

- Upper Band: This line is placed two standard deviations above the middle band.

- Lower Band: This line is placed two standard deviations below the middle band.

These three lines form a “band” around the price of the asset.

The idea behind Bollinger Bands is to show how much the price of an asset is moving up and down, and whether it’s trading within a normal range or experiencing more volatility.

How Do Bollinger Bands Work?

The width of the Bollinger Bands changes based on the volatility of the market. When the market is more volatile, the bands widen; when the market is less volatile, the bands become narrow.

- When the price is close to the upper band: The asset may be overbought, which could be too high, and a pullback might be expected.

- When the price is close to the lower band: The asset might be oversold, meaning the price could be too low, and a potential rise in price might be anticipated.

However, Bollinger Bands don’t predict which direction the market will move in, but they do give clues about whether a trend is strong or weakening.

How to Use Bollinger Bands in Trading?

Now that we know what Bollinger Bands are and how they work, let’s explore how to use them in trading. Below are some popular strategies:

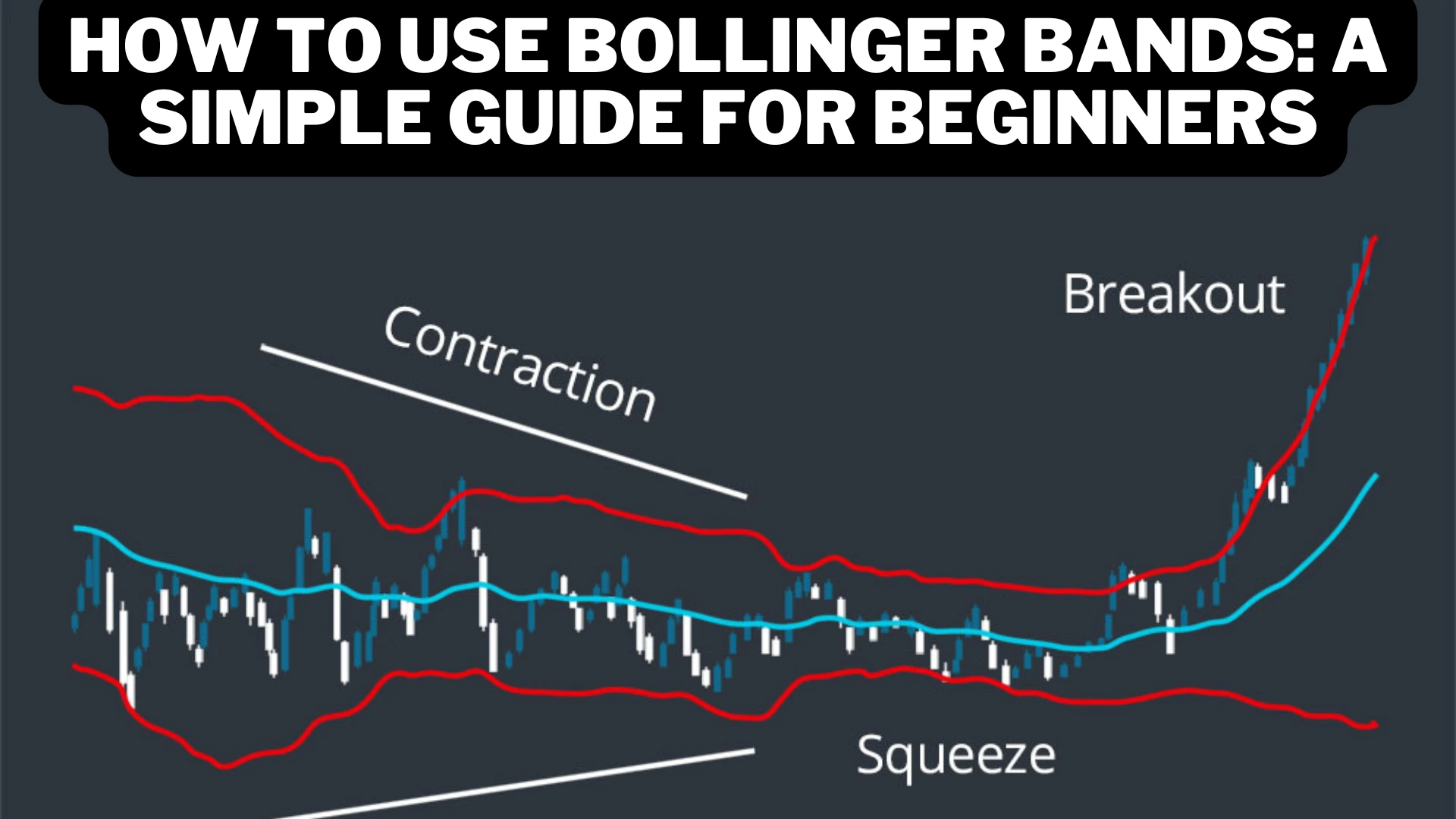

1. Bollinger Band Squeeze

The Bollinger Band Squeeze is one of the most commonly used strategies. A squeeze occurs when the bands narrow significantly, indicating that volatility is low and the price could break out in either direction.

- What to look for: When you see the bands squeezing close together, it could mean that a big move is about to happen. Traders wait for the price to break above the upper band for a bullish signal or below the lower band for a bearish signal.

2. Bollinger Band Breakout

Another strategy is to look for breakouts from the bands. When the price moves outside the bands, it signals that the market is in an extreme position.

- What to look for: If the price breaks above the upper band, it can signal that the asset is overbought, meaning a price reversal might occur. Conversely, if the price breaks below the lower band, it may indicate that the asset is oversold and the price might bounce back soon.

Keep in mind, that breakouts alone aren’t always reliable. Combining them with other indicators or price patterns is essential to confirm your trade.

3. Using Bollinger Bands With Other Indicators

Bollinger Bands work best when used in combination with other indicators. For instance, the Relative Strength Index (RSI) can be used alongside Bollinger Bands to give more context to overbought or oversold conditions.

- How to use: If the RSI indicates that an asset is overbought (above 70), and the price is near the upper Bollinger Band, it might be a good time to sell. On the flip side, if the RSI shows oversold conditions (below 30) and the price is near the lower band, it might be a buying opportunity.

Tips for Using Bollinger Bands

Here are some useful tips for getting the most out of Bollinger Bands in your trading:

- Don’t Rely Solely on Bollinger Bands: While Bollinger Bands are a powerful tool, they shouldn’t be the only indicator you use. Always combine them with other indicators like RSI, moving averages, or candlestick patterns for confirmation.

- Understand Market Conditions: Bollinger Bands work well in trending markets as well as sideways markets, but the strategies will vary. For trending markets, focus on breakouts, while in sideways markets, you can use the bands to identify overbought and oversold levels.

- Practice Before Trading Real Money: If you’re new to Bollinger Bands, practice using them on a demo account first. This allows you to get comfortable with how they work without risking real money.

- Use the Default Settings at First: The standard settings for Bollinger Bands (a 20-period moving average and two standard deviations) work well for most situations. As you gain experience, you can experiment with different settings to see if they work better for your specific trading style.

Final Thoughts

Bollinger Bands are an excellent tool for traders looking to measure volatility and identify potential entry and exit points.

They offer valuable insights into market conditions, especially when used with other indicators.

Remember, no indicator is foolproof, and it’s essential to develop a comprehensive trading plan that includes risk management.

By mastering the use of Bollinger Bands, you can add a powerful tool to your trading toolkit, giving you an edge in the markets.

Take your time to practice, test out different strategies, and see how Bollinger Bands can work for you.